Editor’s Note: This article was originally published in the February 2021 issue of JED. To read past issues in full, visit our magazine archive.

Not too long ago, some very enterprising people asked themselves a question: If almost anyone can access spacecraft-delivered, high-quality images, and accurate geolocation of most places on Earth for a fee, why not add RF signals to the mix? The answer, as it turns out, is that this is not just an interesting idea but a potentially lucrative market. As readers of JED would quickly conclude, such a service would seem to infringe on defense and intelligence agencies throughout the world who would take a dim view of commercializing space-based electromagnetic warfare (i.e., ESM) and signals intelligence (SIGINT) services. However, these same agencies are already expressing interest in the business as an adjunct to their existing resources. And they’re not alone, as potential commercial uses range from tracking poachers and illegal fishing vessels to vessels used for human trafficking.

But first, keep in mind that for the US Department of Defense (DOD), the use of commercial space assets is nothing new. DOD and other government agencies spend millions of dollars every year for the use of commercial satellite communications and other services to complement their own formidable capabilities. The major satellite service providers, such as Inmarsat, Viasat, and Iridium, have long relationships with DOD and other government agencies throughout the world.

Peraton, the former government services business unit of Harris Corp. now owned by Veritas Capital, in October added to its already substantial government satcom business with a $10-million, 5-year contract from the Space Force for orbital analysis services. However, defense agencies aren’t the only entities that could benefit from commercial space-based SIGINT services.

In fact, the commercial market represents space-based RF tracking opportunities that, if not as lucrative as defense, are more diverse, from shipping to poaching, and piracy, to name a few. The most likely commercial target is the shipping industry, the world’s largest user of commercial satellite services for geolocation and communications. This includes more than 50,000 registered container ships, bulk cargo carriers, oil, gas, and chemical tankers, and passenger ships traveling through international waters. Tracking them is obviously essential, especially in congested waterways, and the basic tool for achieving this is the Automatic Identification System (AIS).

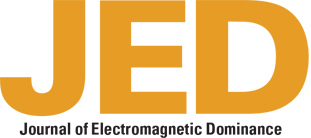

HawkEye 360’s RFGeo product can track X- and S-Band radar emissions from “dark” ships. HAWKEYE 360

The International Maritime Organization’s Safety of Life at Sea (SOLAS) regulation requires all vessels of 300 gross tons more and passenger ships of any size to have AIS transceivers installed. AIS originally sent signals from boats to land stations over a distance of about 20 miles, but more recently low-earth orbiting (LEO) satellites are used for this purpose and can be harnessed for other uses, such as search and rescue operations.

The automated system broadcasts signals to and from transponders operating at VHF frequencies, with the data displayed via monitors on each ship and at land-based monitoring stations. The complete data package is extensive and includes the ship’s unique identifier that fully describes its position, a timestamp, and its cargo, destination and route plan. Position and timing information is derived from GPS, and other information is obtained from shipboard equipment.

In an ideal world, AIS information would be sufficient to authenticate each vessel and ensure ships don’t collide. But not all ships and their cargos are what they say they are. Pirates, fishing vessels operating in protected waters, and oil tankers from nations under sanction use spoofing, hijacking for deception, and some will also turn off their AIS transponder. Although the AIS is supposed to be switched on at all times, ship captains have the discretion of turning them off for various reasons. And when AIS is off, the ship effectively goes “dark,” to many vessel traffic monitoring systems and no exchange of information takes place, which for obvious reasons creates a very dangerous maritime environment.

Of course, manipulating AIS does not preclude a vessel’s detection by space-based optical and RF sensors. Historically, satellite imagery and SIGINT collection has only been available to military users and intelligence agencies. The first real-time satellite imagery was provided by a US KH-11 satellite in 1977. The history of SIGINT satellites is even older, going back to 1960, when the US launched the first of five low earth orbit Galactic Radiation and Background (GRAB) satellites to monitor Soviet radar emissions.

As the commercial space market began to evolve beginning the 1960s, more payload types were gradually introduced into orbit. Commercial satellite imagery became widely available in the early 2000s. Today, companies such as DigitalGlobe provide high-resolution still and video images for a fee, a market that has grown to $5 billion today with projected growth to more than $7 billion by 2024. Their services are used by a diverse array of organizations from the shipping industry, defense agencies, environmental groups, the World Health Organization, and hundreds more – including resourceful investigative journalist consortiums like Bellingcat – that combine their images with data from other sources to provide forensic analysis of events such as Russia’s role in the downing of Flight MH17 over Ukraine in 2014.

AIS and commercial digital mapping services provide an extraordinary amount of real-time information, but one other element has been missing: monitoring RF emissions from the Earth’s surface – a hole that a new cadre of companies hopes to fill. The barrier to entry into this market would have until recently been the extremely high cost of building and launching satellites, but the emergence of very small satellites has stripped this impediment away.

CUBESATS: MAKING SPACE-BASED SIGINT POSSIBLE

These spacecraft, collectively called CubeSats based on their form factor, are classified according to their weights. Femtosats weigh less than 0.1 kg, picosats 0.1 to 1 kg, nanosats 1 to 10 kg, microsats from 10 to 100 kg, and minisats from 100 to 1000 kg. Their small size allows them to be densely packaged inside a rocket so that dozens can be carried and deployed in a single launch. They cost a small fraction to build and launch when compared with their traditional satellite counterparts, and they can be manufactured faster and placed in orbit cost-effectively by piggybacking on the launch of larger payloads.

Although CubeSats aren’t new, having first been developed at Stanford University in 1999, advances in various technologies have transformed them into small but powerful platforms. The basic unit for the first satellite proposed by the Stanford researchers was defined as a 1U cube with dimensions of 10×10×10 cm. Using this as its basis, CubeSats can range in size from 1U to 16U, so a 2U nanosat could weigh 2.66 kg and measure 10×10×20 cm. CubeSats are restricted to a maximum radiated RF power of 1 W (30 dBm) for establishing downlink communication to earth stations, while earth stations can deliver to 100 W (50 dBm) in the uplink direction.

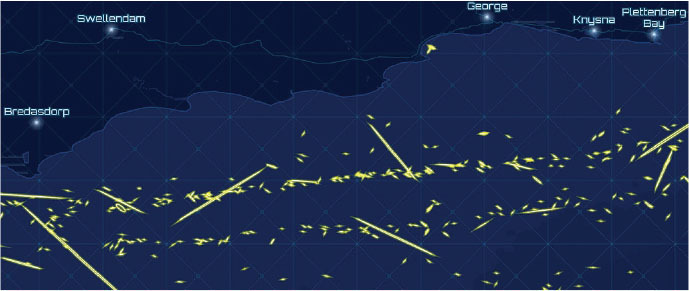

Hawkeye 360 delivered its Cluster 2 satellites to Cape Canaveral, FL, in mid-December. They are expected to launch on a Space X Falcon 9 rocket in the first quarter of 2021. HAWKEYE 360

The coverage provided by a CubeSat mission depends on the number of satellites, the number of orbital planes, the elevation angle, the inclination, the altitude, the orbital plane spacing, and the eccentricity of the orbit. All current CubeSats have been deployed in LEO in part to mitigate the platform cost and complexity, but also to support low-latency communications from the satellite to Earth stations and back to the satellite.

A good example of current CubeSats is the SpaceX Starlink program, which is dedicated primarily to providing commercial broadband service everywhere on Earth. Although the Starlink constellation does not provide SIGINT, the program illustrates how cost-effective this approach can be. The program has piqued the interest of the Army, which is examining the possibility of using the Starlink constellation as a low-cost, highly accurate, and almost unjammable alternative to GPS. The Army already has a relationship with Starlink to explore moving data across military networks.

SpaceX launches 60 satellites into low Earth orbit from a single Falcon 9 rocket. They are designed to deorbit in 5 years or less, mitigating what would otherwise add to the increasing amount of space junk. Elon Musk says the entire cost of the program is expected to be about $10 billion, and although his projections are sometimes optimistic, even if the actual cost is five times that much the program would still be comparatively cheap.

Last November, SpaceX began sending out email invitations for public beta testing of the service, which Musk calls “Better Than Nothing Beta.” The company currently has nearly 900 satellites in orbit and plans to continue launching them until it achieves its goal of downlink latency between 16 and 19 msec by this summer. To no one’s surprise, Jeff Bezos plans to develop its own satellite constellation, called Project Kuiper, adding yet another arrow to Amazon’s quiver. The company announced in December that it has developed and tested a 12-in.-diameter K-band phased array antenna for the user terminal that can deliver downlink speeds of 400 Mbps.

There are at least 20 companies throughout the world that design and build CubeSats, a number that does not include government research organizations, universities, prime government contractors, or any companies in China, so the total is much, much larger. Each one competes on one or more factors that differentiate it from others, and the result is a very competitive market.

A NEW BUSINESS MODEL EMERGES

“We thought, there are commercial electro-optical and radar observation assets, so why not RF domain commercialization,” says John Serafini, CEO of HawkEye 360, the first company to enter the space-based RF monitoring market and one of the very few with satellites in orbit. After its founding in 2015, the company launched this first three-satellite constellation less than 3 years later in 2018. “We set out to build a constellation of small satellites flying in formation in clusters of three”, says Serafini “with two in the front and one in the back that oscillates back and forth to gain a 3D view of the emitter and to perform accurate geolocation. Our differentiator is our ability to process and analyze the data using Machine Learning and other tools,” says Serafini.”

“As this is a brand-new market that has never existed outside of the classified domain, we’re building the market from scratch, split between the government and commercial entities for RF interference detection,” he continues. “Potential markets include RF analytics for spectrum monitoring, maritime tracking and analytics, insurance, fishing companies, and cruise ship operators. Our goal is to have a balance between defense the humanitarian activities, such as anti-poaching.”

Citing spectrum monitoring, Serafini notes that it is difficult to collect terrestrial spectrum data from the ground because the interfering signal has to be pinpointed by driving around in trucks of three to triangulate and achieve geolocation. Satellites can deliver this capability every 15 minutes or so. Dark ships are also a major problem, from human smuggling to drug trafficking, oil transport, and other activities. “As they cannot be found and there is no law enforcement capability for tracking those vessels,” says Serafini, “we can provide these capabilities by monitoring their radars, radios, and other emitters.”

The company developed its first three satellites, known as Hawk-A, -B and -C, under the Pathfinder mission. The company contracted with the University of Toronto’s Institute for Aerospace Studies, Space Flight Laboratory to design the platform based on its 15-kg NEMO microsatellite bus. Deep Space Industries (San Jose, CA), which is now part of Bradford Space, developed the propulsion system. The three satellites were launched aboard a Space X Falcon 9 rocket into LEO on a 97-degree, 590-km orbit in March 2018.

The company has built three subscription packages to serve various types of companies. RFGeo is HawkEye 360’s RF signal mapping product. The RFGeo analytics package provides global geospatial data to enable RF spectrum awareness and uses the data generated by the satellites to identify and geolocate RF signals of interest from VHF through Ku-band including VHF marine radios, UHF transceivers, V-and S-band radars, AIS, and EPIRB beacons.

The Regional Awareness Subscription is the company’s RF signal mapping product that identifies, geolocates, monitors and analyzes RF emitter behavior over time. The SEAker service is dedicated to the maritime environment and locates vessels even if they attempt to hide by deactivating their AIS or spoofing its signal. The company plans to add the ability to include sanctions data to vessel information, as well as providing fused data sets. These include independent RF geolocation of VHF and maritime signals, spoofing detection to indicate when a vessel’s self-reported GPS location doesn’t match the one detected by Hawyeye360, as well as a vessel registry that contains a continuously-updated record of RF signatures and activity over time.

HawkEye360 has gained significant momentum in the US defense market and has five more satellite clusters under development for launch this year and next. The growing constellation identifies and precisely geolocates emitters from a broad set of signals transmitted by VHF marine radios, UHF push-to-talk radios, maritime radar systems, AIS beacons, L-band satellite devices and emergency beacons.

Another company is Kleos Space, founded in Luxemburg in 2017 with the goal of serving the maritime market. Their offering is intended to provide a global picture of hidden maritime activity, enhancing the intelligence capability of government and commercial entities when an AIS signal is not available, imagery is unclear, or vessels are out of patrol range.

The company delivers “RF reconnaissance data as a service,” collecting information about maritime emitters and selling it to defense organizations and agencies, including those that undertake search-and-rescue operations, as well as commercial customers. Kleos launched its first four RF reconnaissance satellites – collectively called the Scouting Mission (KSM1) – in November on an Indian Space Research Organisation Polar Satellite Launch Vehicle (PSLV). The KSM1 cluster, manufactured for Kleos by GomSpace A/S (Aalborg East, Denmark), were deployed in a diamond formation on a 37-degree inclined orbit that enables them to cover areas such as the Strait of Hormuz, South China Sea, Africa, the Southern Sea of Japan and the Timor Sea. The satellites, which are built around software defined radios, will monitor VHF signals and geolocate them via time-difference-of-arrival (TDOA) techniques. Additional monitoring capabilities could eventually cover satellite phones.

Kleos Space launched its Scouting Mission KLM1 cluster in November. It plans to launch its second cluster in mid-2021. KLEOS SPACE

Following their November 7 launch, the first four Scouting Mission satellites underwent a three-month commissioning process, known as the Launch and Early Orbit Phase (LEOP). Once the KSM1 cluster is fully commissioned, the company’s mission operations team will take over responsibility sometime this month. The notion of providing space-based ESM is very attractive to many defense and commercial organizations, and Kleos has already signed agreements with several customers. In May, the company said it had received a contract award from the Utah State University Space Dynamics Laboratory (SDL) in collaboration with the US Air Force Research Laboratory (AFRL) under the Micro-Satellite Military Utility Project Arrangement (MSMU PA). The company will deliver its RF emitter data to MSMU PA members, which include defense and intelligence organizations in Australia, Canada, Germany, Italy, Netherlands, New Zealand, Norway, the UK and the US. The MSMU PA is forging a pathway to a larger effort, known as the Multinational Heterogeneous Space Enterprise (ISR Enterprise), which will provide a range of satellite-generated information (electro-optic, synthetic aperture radar, AIS) to international partners.

Another recent customer is the Chilean Air Force, which in December signed on for a trial evaluation of the company’s service. With Chile’s 6,000 km of Pacific coastline and several islands far off shore, the Chilean Air Force will use Kleos data to help it monitor maritime activity in its territorial waters and beyond. Brazil’s Agência Nacional do Petróleo, Gás Naturale Biocombustíveis (ANP) has also signed on for a trial demonstration. It hopes to use the company’s emitter data and combine it with other space-based sensor data to identify illegal pollution and other environmental crimes. Kleos Space has also signed a contract with Intelligence Management Support Services Ltd (IMSL) in the UK, which will buy purchase Kleos Scouting Mission data and sell it along with analytics services to government and industry customers.

As the KSM1 satellite cluster becomes fully operational, the company is readying its next satellite deployment in June aboard a Space X Falcon 9 launch vehicle. This cluster, the Polar Vigilance Mission (KSF1), also comprises four satellites. They will be deployed in a 500-km Sun-synchronous orbit to monitor the northern and southern polar regions. For the KSF1 satellites, Kelos is working with a new partner, Innovative Solutions in Space (ISISpace), in Delft, The Netherlands. Kleos is raising funds to build a third satellite cluster by the end of 2021. Its ultimate aim is to launch 20 satellite clusters.

A third company pursuing this market is Unseenlabs based in Rennes, France. Founded by two brothers in 2015, the company has developed and launched three Breizh Reconnaissance Orbiter (BRO) satellites that are used track maritime vessels via their RF emissions (the company will not disclose which types of frequencies it is monitoring) and sell the data as a service to various types of customers. Its receiver also performs specific emitter identification (i.e., RF fingerprinting) of each signal, which enables its tracking system to follow specific ships through an area.

Unseenlabs launched its first satellite (BRO-1), a 6U CubeSat, on a RocketLabs Electron launch vehicle in August 2019. BRO-1, which was manufactured by GomSpace, was deployed in a 540-km, 45-degree orbit. The next two satellites (BRO-2 and -3) were launched in Novem ber 2020 into a 500-km, 97-degree orbit to provide further coverage. The company is building three more satellites, which it plans to launch by the end of 2021.

Another company hot on the heels of HawkEye 360 is Horizon Aerospace Technologies headquartered in the UK, whose CEO John Beckner basically built the company from scratch based on a long career in the aerospace industry and various projects that culminated in a SATCOM monitoring product called Flying Fish. The product got its name from a system called Marlin that is a tactical satellite intercept system for passive monitoring of communications networks and built by L3Harris TRL Technology in the UK.

Based on his relationship with L3Harris TRL, Beckner created Flying Fish, which can be configured for use in platforms ranging from ground vehicles to unmanned aerial systems, fixed-winged aircraft, and CubeSats, and passively monitors communications on the Thuraya or IsatPhone Pro networks as well as L-band signals. The company’s latest entry is its AMBER constellation of CubeSats, yet to be launched, that will offer SIGINT as a service (SAAS) for maritime domain awareness (e.g., illegal fishing, smuggling and trafficking, piracy, and terrorists.

The payload will be able to locate and track vessels worldwide by detecting their RF emissions using the FlyingFish system along with X-and S-Band sensors and an AIS receiver. Revisit times are expected to be 4 to 7 to each covered global region per day, with the second generation reducing this to 1.5 to 2 hours, and the full constellation to less than an hour.

Most entrants in this market are concentrating on signal identification and analysis (i.e., ESM) and staying away from demodulating the signals to gain traditional SIGINT insights into their waveforms and other characteristics. However, Horizon Technologies (Reading, UK) will offer these SIGINT capabilities, as long as the subscribing country falls into the “friendly” category and Horizon gets approval to serve them.

The data would need to pass directly to the subscriber in raw form that can be used within the country’s existing SIGINT analysis platforms. This approach not only provides the required security but also eliminates the need for Horizon to develop an interface to serve each customer.

The company announced in November that it shipped its first AMBER 6U CubeSat payload (known as IOD-3) to AAC Clyde Space in Glasgow, Scotland, which is now undergoing testing and will be integrated into the AAC Clyde Space bus in preparation for launch in the middle of this year. Once deployed and operational, the AMBER satellite will be operated from the company’s Technologies’ Amber Ground Exploitation Station (GES) in Newquay, UK.

In November, AMBER Horizon Space Technologies delivered its first AMBER CubeSat payload to AAC Clyde Space in preparation for a scheduled launch in mid-2021. ´AMBER HORIZON SPACE TECHNOLOGIES

IN ORBIT

The space-based RF reconnaissance industry is, if not embryonic, then certainly in the early stages of development. It is emblematic of the “New Space” market – exploiting a number of innovations, such as commercial launch platforms, smaller satellite form factors and turn-key satellite designs and manufacturing. This market will in no way replace the space sensing capabilities of major space nations. But no one expects them to do that, either. More likely, these RF emitter monitoring services will complement the ISR capabilities of some defense organizations, and they will likely enable smaller countries that cannot afford to develop, sustain and upgrade their own space-based monitoring capabilities to obtain real-time data on maritime traffic.

The most important factor in this RF reconnaissance market is that its primary customer base is the commercial sector rather than military users. While this article covers the early entrants into this market, there is nothing stopping companies such as Inmarsat with enormous space assets to add SIGINT capabilities to their service portfolios. Not surprisingly, one of the other question marks concerns China, which has the benefit of enormous state-funded resources, formidable technology, and the unique ability to price its services at any level likely to secure a customer. The leader in China is HEAD Aerospace, whose three-axis-stabilized Skywalker satellites are built by the Shanghai Academy of Spaceflight Technology and employ a high-performance AIS receiver capable of processing 2 million AIS short messages every day and identify 60,000 ships. The Skywalker constellation is expected to consist of 48 satellites in various orbits.

This being said, the basic concept of providing space-based EW and SIGINT is undeniably sound. What remains to be seen is how these companies can differentiate themselves, how much DOD and other national defense agencies are likely to use their services, and the ability of small countries with limited signal monitoring capabilities to afford them. Regardless, this is a market to watch.